The Singularity

The Singularity refers to an acceleration of technological innovation to the point that society rapidly becomes unrecognisable. Economic data is not supportive of The Singularity in the near term.

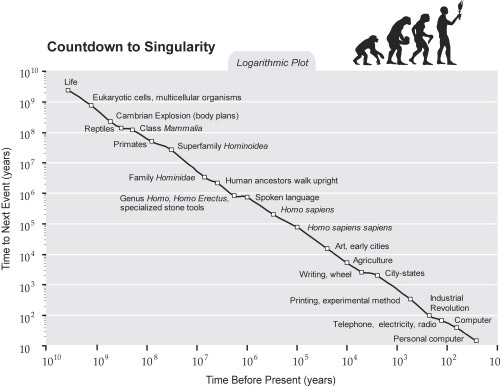

Ray Kurzweil popularized the concept of a technological singularity in the early 2000s, brought about largely by artificial general intelligence, although the concept dates back to at least John von Neumann and Stanislaw Ulam in the 1950s. Kurzweil estimated that The Singularity would occur around 2045, based on a projection from past biological, sociological and technological progression. A strong argument can be made against an impending technological singularity though, as this hypothesis is a naïve projection which ignores how innovation occurs and diffuses through society at a granular level.

Figure 1: Countdown to The Singularity (source: www.singularity.com)

Rather than discuss the feasibility of The Singularity though, the economic impact and possible indicators of its arrival are considered. Potential causes for this acceleration in productivity growth are discussed but are not important to the larger economic impact.

The Singularity

The Singularity is a proposed discontinuity in human progress where technological innovation accelerates to the point that dramatic changes in society happen in a short period of time. In the most common hypothesis, The Singularity is attributed to an intelligence explosion as the result of artificial intelligence capable of general problem solving, including upgrading itself. This AI would accelerate economic growth and create the increasing returns on inputs required for The Singularity to occur.

Growth

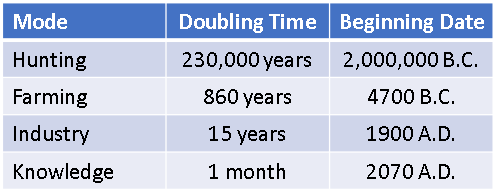

Human history has been described as the slow expansion of hunter-gatherers, followed by increased growth after the domestication of plants and animals and even faster growth following the development of commerce, science and industry. Farming largely substituted for hunting resulting in a rapid transition, while industry complemented farming causing a more gradual transition.

Each production mode increased global output by a factor of a few hundred and resulted in growth several orders of magnitude greater than its predecessor. Based on this, a new mode that results in a monthly doubling time (4096x increase annually) could be expected within the next century.

Table 1: Historical Modes of Economic Development (source: George Mason University)

In the event of a singularity it is questionable whether unbounded demand growth would really occur or if at some point human needs would be completely fulfilled. This would likely be the result of a scarcity of attention, with humans only having so much time available for consumption. Sentient artificial intelligence, driven by its own desires, may then largely be responsible for economic activity and dictating what the majority of output is.

Growth Model

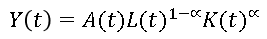

Economic output is generated from resources like labour, capital, land and energy and for output to grow, the supply of resources must either be increased or technology improved so that resources are better utilised. If The Singularity were to occur, output would become divorced from inputs and economic growth would occur independently of labour and capital. In the Cobb-Douglas production function, this would require total factor productivity approaching infinity.

Where:

0 < α < 1 is the elasticity of output with respect to capital

Y(t) is total production

A refers to productivity augmenting technology (knowledge)

L(t) is the labour input

K(t) is the capital capital

Equation 1: Cobb-Douglas Production Function

AI and robotics, which render labour obsolete in economic activity, would be essential to achieving this type of growth in productivity. Nanotechnology or a similar technology which limits reliance on resources would also be required. Not only do these technologies not currently exist, they do not even realistically appear to be on the horizon. In the absence of these technologies, the most likely scenario for a singularity type event would be for the knowledge economy to increasingly dominate output, along with narrow AI continuing to improve the productivity of knowledge workers. This is because the knowledge economy is generally not capital or resource intensive. Even in this case, physical limitations may quickly be reached, limiting the extent of progress.

A singularity type event could arise from either the demand or the supply side becoming dominated by the knowledge economy. On the demand side, consumers could shift spending toward high productivity growth industries. On the supply side, production would have to have sufficient substitutability that the input bundle moves toward rapidly improving information capital as growth proceeds. If information and conventional resources are elastic substitutes, either in consumption or in production, growth will rise, perhaps extremely rapidly. However, if information and conventional resources are inelastic substitutes in production and consumption, rapid improvements in information technology will eventually be irrelevant to the economy.

Demand

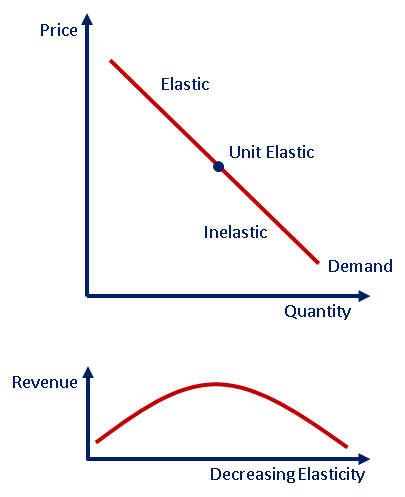

A demand driven singularity would occur if the demand for goods and services exhibiting large productivity increases is elastic, and remains elastic as price declines. Very few goods or services will have insatiable demand though, meaning that as prices decline it is likely demand will become inelastic at some point.

Figure 2: Price Elasticity of Demand and Revenue

This can be assessed by looking at the relationship between the shares of different goods in total consumption and the trends in relative prices. Data in the U.S. shows that industries with falling relative productivity and rising relative prices tend to have a rising nominal share of output and employment. Examples of this would be the rising importance of healthcare, housing and education. It is therefore unlikely that a demand side driven singularity will occur.

Supply

Assuming that accelerating productivity growth is only achievable with information capital:

If the elasticity of substitution is greater than one, then information capital takes an increasing share of inputs, and the growth of productivity rises.

If the elasticity of substitution is less than one, then information capital’s share in production declines over time, and the growth in aggregate productivity tends toward the growth of the relatively fixed factor, labour.

In the unit-elastic case, productivity growth tends to a constant rate.

Without significant improvements in robotics and AI, it is likely that the elasticity of substitution will remain less than one, making a supply side driven singularity improbable. Even with elastic substitution, the assumption of accelerating productivity growth as knowledge scales is likely a bad one. Like most things, knowledge probably has diminishing returns with scale.

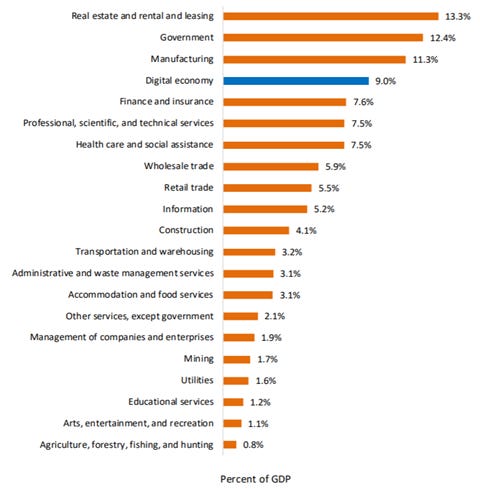

Economic Contribution by Sector

The key question for assessing the likelihood of The Singularity is the extent to which information can be substituted for conventional inputs. Essentially meaning that technologies like AI and robotics must be able to replace all other inputs. This is more likely in the services sector than the agricultural and industrial sectors, as these rely on inputs like raw materials and land. Economies like the U.S. that are predominantly based on services are more likely to be amenable to The Singularity than economies like Indonesia that rely more on the agricultural and industrial sectors. Even within the services sector though, there are few applications where information is the only required input with current technology.

Table 2: Economic Contribution by Sector for Various Countries (source: CIA)

By my rough estimate, only approximately 30% of GDP could be considered highly scalable with existing technology or technology feasible in the near future.

Figure 3: U.S. Economic Contribution by Industry (source: BEA )

Indicators of The Singularity

Based on the preceding discussion, potential indicators of an impending technological singularity include:

Rising productivity growth

Capital’s share of income rising towards 100%

Rising real capital output ratio

Information capital’s share of total capital rising towards 100%

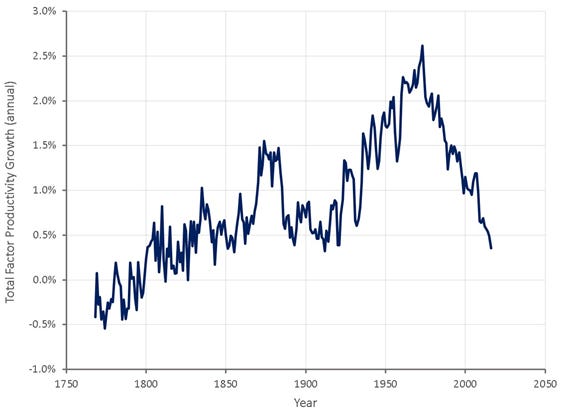

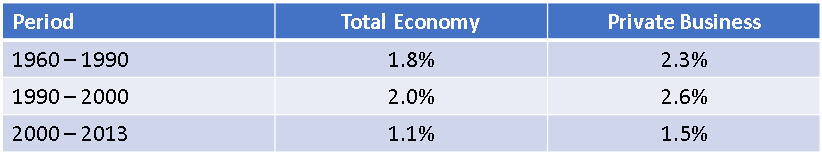

Productivity

Productivity growth has been declining for the past 50 years and based on this, there is no reason to believe that we are approaching any type of singularity. It would be more reasonable to conclude that progress is beginning to plateau as a result of some type of limitation.

Figure 4: U.K. Total Factor Productivity Growth (source: The Federal Reserve)

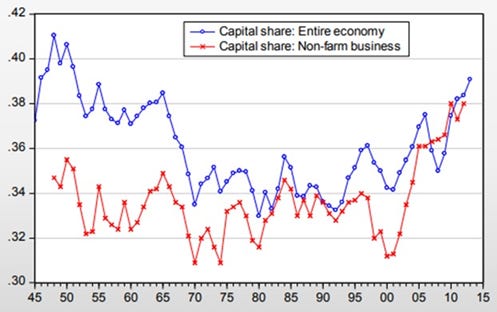

Capital’s Share of Income

The Singularity would result in capital’s share of national income increasing significantly. Recent experience is broadly what would be expected, although gains so far have been relatively modest.

Figure 5: U.S. Capital Share of Income (source: nber)

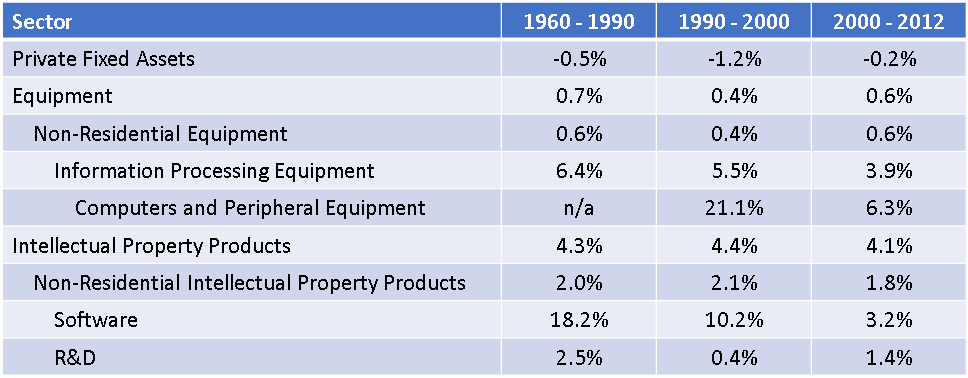

Capital Output Ratio

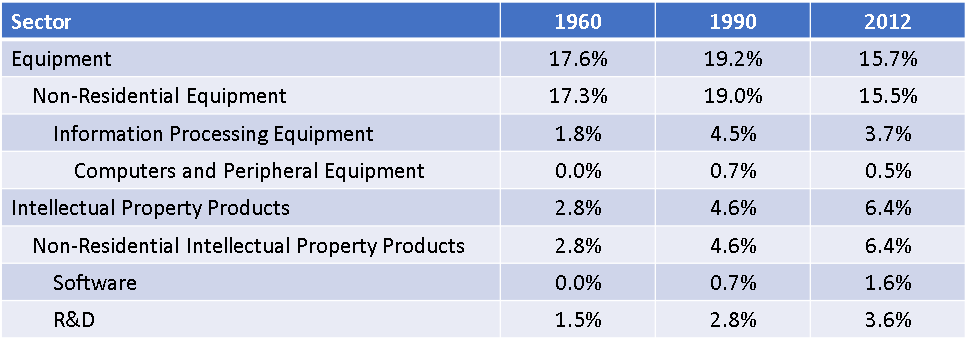

If The Singularity was being approached, growth of the capital output ratio would be accelerating. Growth rates of real capital output ratios have been declining across a range of sectors, including sectors like computers and peripheral equipment, software and R&D. Based on this there is no evidence that The Singularity is on the horizon.

Table 3: U.S. Growth Rate of Capital Output Ratio (source: nber)

Information Capital’s Share of Total Capital

Information capital’s share of the capital stock should approach 100% in the event of The Singularity. Information capital’s share is increasing slowly, which is supportive of The Singularity, although not in the near term.

Table 4: Information Capital’s Share of Total Capital (source: nber)

Wage Growth

The impact of The Singularity on wages depends on to what extent technology completely replaces workers versus making them more productive in their current jobs. This is referred to as the substitution effect and the complementary effect. Machinery and automation can increase the demand for complementary labour but they also substitute for labour. In the past the complementary effect has tended to dominate, causing wages to rise, but AGI could result in a large amount of substitution with little complementary effect, causing wages to decline. The impact of The Singularity on wages will likely be highly heterogeneous, with wages increasing for some and declining or even being eliminated for others.

It is likely that The Singularity would initially result in higher wages, before labour is largely eliminated and wages collapse. Growth in wages has been relatively stagnant in recent years, which is not indicative of The Singularity.

Table 5: Increase in Real Wages (source: nber)

Conclusion

For The Singularity to occur, human labour and intelligence need to become increasingly superfluous. While narrow artificial intelligence continues to improve, there is no evidence that the artificial general intelligence necessary for The Singularity to occur is on the horizon.

The data suggests The Singularity is not near, but over time as information technology becomes increasingly dominant, some of the below trends may play out:

Total factor productivity may increase modestly

Capital’s share of income may rise

The real capital output ratio may rise

Information capital’s share of total capital may rise

It should be noted that these trends are broadly in line with Marc Andreesen’s “Software is Eating the World” thesis from 2011.

If anything, stagnation appears more likely than The Singularity and there are a number of structural reasons to suggest this situation will persist. This should not be seen as a Malthusian argument though, as population growth is likely to remain low, technological progress will continue and the global economy will continue to be less reliant on natural resources.